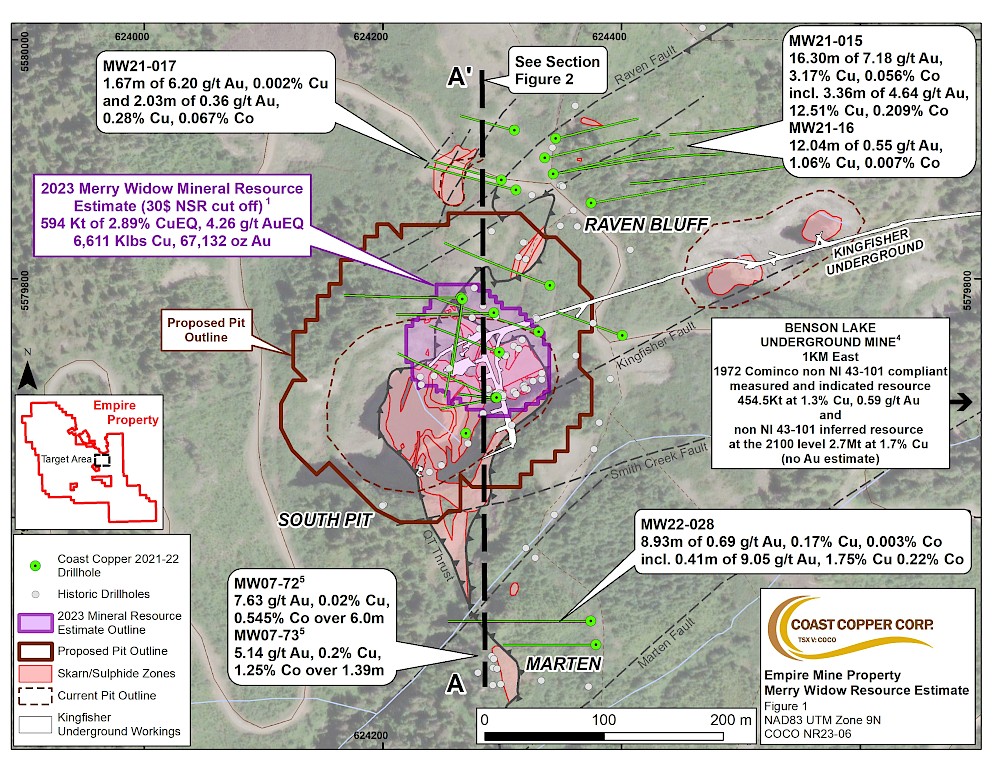

Vancouver, BC – Coast Copper Corp. (“Coast Copper” or the “Company”; TSX-V: COCO) has identified four exploration targets each with the potential to expand Coast Copper’s recently announced National Instrument (“NI”) 43-101 Mineral Resource Estimate (the “2023 MRE”) for the gold-copper Merry Widow open pit located at its optioned Empire Mine property (“Empire Mine“ or the “Property”) on northern Vancouver Island, B.C. – see news release May 23, 2023.

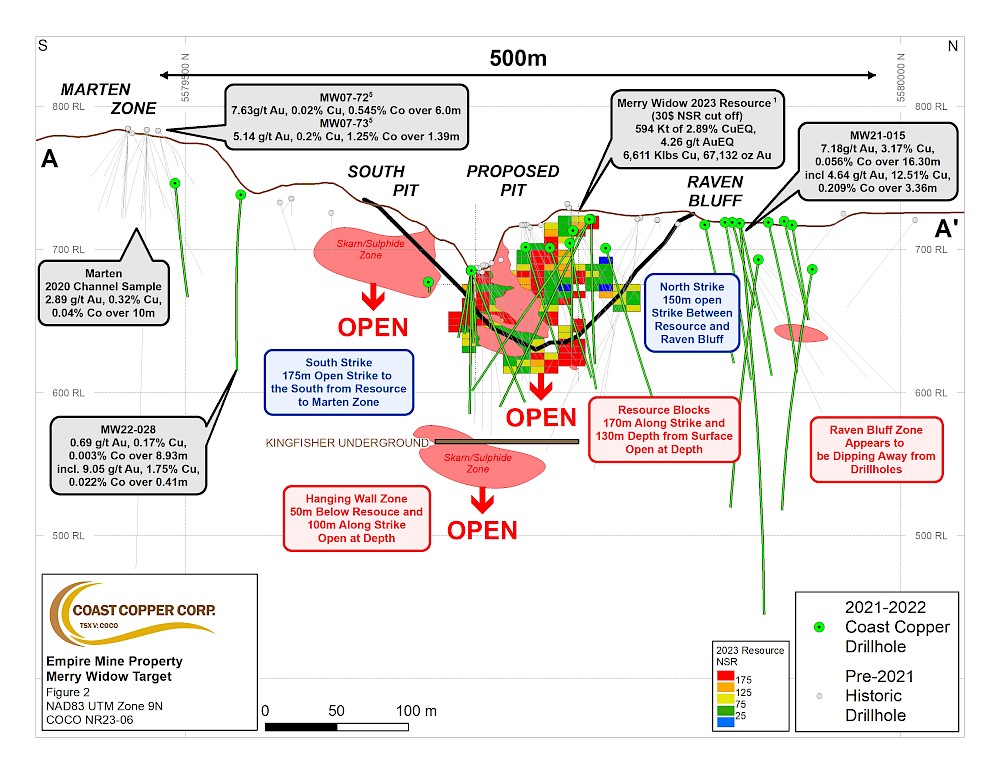

The 2023 MRE for the Merry Widow open pit hosts an inferred resource of 81,322 ounces (“oz”) gold equivalent (“AuEq”) grading 3.52 grams per tonne (“g/t”) gold (“Au”) and 0.50% copper (“Cu”) [4.258 g/t AuEq] within 0.59 million metric tonnes Mt), using a net smelter return (“NSR”) cut-off of $30 CDN1 . The 2023 MRE covers a 170-meter (“m”) strike length to a depth of 130 m below surface. The Merry Widow resource is open along strike and down-dip based on a review of the updated geological model, historical data review and the 2023 MRE. This updated information shows the potential to grow the resource footprint (in what has been defined as the “upper zone”).

The four drill target areas that could potentially expand the 2023 MRE are:

1. Along strike to the north-northeast (“NNE”) for at least 150 m to the Raven Bluff zone,

2. To the south for at least 200 m to the Marten zone,

3. At depth for at least 70 m based on geological mapping and sampling from the Kingfisher underground, as well as the geological observations noted while historically mining magnetite in the 1960s, and

4. the footwall of the magnetite bodies as noted in 1989 drillholes and observed along the footwall of the current pit.

Adam Travis, Coast Copper CEO comments: “Our drilling, together with our updated geological models, have increased the grade of the Merry Widow resource into a 4.26 g/t gold equivalent pit1. Our team has been working on the potential expansion of the 2023 MRE, focusing on several zones proximal to the current resource. The updated Merry Widow MRE represents 175 m of the 500 m open strike length from Marten to Raven Bluff. This could potentially double or triple the 2023 MRE. The recent emphasis with regards to critical elements including copper has also been the impetus for the Company to review potential credits for cobalt, silver and magnetite, which could add to the current copper and gold resource.”

2023 Geological Targets Details (see Figures 1 and 2):

1. The Geological Target on strike to the NNE has a volume which indicates potential to double the resource –initial drilling by Coast Copper in the Raven Bluff area (approximately 150 m NNE of the Merry Widow pit) had drillhole MW21-16 which returned 7.18 g/t Au and 3.17% Cu over 16.28 m.

2. South strike potential – during the magnetite mining between 1962-1968, sulphide mineralization was observed south of the Merry Widow pit in an area noted as South Pit towards the Marten zone. Mapping and sampling have identified a sulphide zone from the southern end of the Merry Widow pit with dimensions of 60 m by 25 m based on the surface mapping and sampling.

3. Hanging wall zone – the 2008 historical resource2 was known to be open to depth and is reinforced with new, modern underground surveys, geological observations and sampling which outlines magnetite and massive sulphide mineralization within the Kingfisher underground. This area occurs from the base of the 2023 MRE to the Kingfisher underground which is 50 m below and extending along strike for 100 m.

4. Footwall zone – historical work from Taywin Resources between 1989-1991 has noted a zone of sulphide mineralization located in the back wall of the pit behind the magnetite workings. Although these drillholes were not used in the resource estimate due to lack of QA/QC for the assay results, their geological observations combined with observations in the pit indicate a potential target zone.

Future Work

As demand and awareness concerning Critical Minerals increases, Coast Copper has undertaken a review of secondary elements which could add to the value to the deposit. The Company observed massive magnetite mineralization during its drill campaigns in 2021 and 2022 in and around the historical Merry Widow open pit. It is believed that magnetite could be included in an updated mineral resource estimate, especially given the fact that approximately 1.68 MT of iron concentrate was recovered from the Property between 1957-19673 from both Merry Widow and Kingfisher open pits and underground. Lesser known and understood metals such as silver and cobalt (as noted in the Company’s drilling as well as historical drilling) could potentially also be added to an updated resource once metallurgical properties of these elements is better established.

Drill site locations are being examined by our technical team to determine the optimal targets and spacing to potentially increase tonnage which would add to the current inferred resource. In addition to potentially updating the 2023 MREs, new drilling would also provide sample material for updated metallurgical studies.

Qualified Persons

The technical information contained in this news release has been prepared, reviewed, and approved by Wade Barnes, P.Geo. (BC), Coast Copper’s geological consultant and a Qualified Person (“QP”) within the context of the Canadian Securities Administrators’ NI 43-101; Standards of Disclosure for Mineral Projects.

The 2023 MRE has been provided by Sue Bird, M Sc., P.Eng., Geological and Mining Engineer (NI 43-101 QP) of Moose Mountain Technical Services.

About Coast Copper Corp.

Coast Copper’s exploration focus is the optioned Empire Mine property, located on northern Vancouver Island, British Columbia, which covers three historical open pit mines and two past-producing underground mines that yielded iron, copper, gold and silver. Coast Copper’s other properties include its 100% owned Knob Hill NW Property located on northern Vancouver Island, its Home Brew Property in central B.C., and its Scottie West Property located in the “Golden Triangle” of northern B.C. Coast Copper’s management team continues to review precious and base metals opportunities in western North America.

On Behalf of the Board of Directors:

“Adam Travis”

Adam Travis, Chief Executive Officer and Director

For further information, please contact:

Adam Travis, CEO

Coast Copper Corp.

409 Granville Street, Suite 904

Vancouver, B.C. V6C 1T2, Canada

P: 877-578-9563

E: adamt@coastcoppercorp.com

NR23-06

Notes Related to this news release and/or maps

1. The 2023 Mineral Resource Estimate was prepared by Sue Bird, P.Eng., an independent Qualified Person. The effective date of the mineral resource estimate is April 26, 2023. Mineral Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines, as required by NI43-101. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that any Mineral Resources will be converted into Mineral Reserves. These Mineral Resource estimates include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued exploration. The Mineral Resource Estimate has been confined by a “reasonable prospects of eventual economic extraction” pit using the following assumptions, Prices are based on 3 year trailing averages, recoveries are based on preliminary metallurgical studies, and smelter terms and costs are based on comparables.

Au price of USD$1,800/oz and Cu price of US$ 3.50/lb at an exchange rate of 0.75 US$ per CAD$;

77% Cu metallurgical recovery, 29% Cu concentrate grade, 100$USD/tonne concentrate transport, 100 $USD/tonne concentrate treatment, 1% unit concentrate grade deduction, and 0.1 $USD/lb Cu refining cost

60% Au metallurgical recovery, 99% payable Au, and 8 USD$/oz Au refining cost.

Mining costs of CAD$15/tonne;

Processing + G/A costs of CAD$25/tonne;

Pit slopes of 50 degrees;

The resulting NSR equation is: NSR (CDN$) = (Cu%/100) x 3.96 x 2204.6 x 0.77 + Au x 76.05 x 0.6. The bulk density of the deposit is interpolated from sample data. The average value specific gravity used for the Mineral Resource Estimate is 3.45 at the base case cutoff.

Copper and Gold Equivalents were calculated as: CuEq=NSR/67.22 and AuEq=NSR/45.63

2. A historical NI 43-101 Technical Report, authored by Giroux, G.H., & Raven, W. and dated November 30, 2008, concerning the copper gold resources for the Merry Widow Property was filed on Grand Portage Resources Ltd.'s SEDAR page on January 22, 2009. The 2008 Grand Portage historical resource estimate, completed by Gary H. Giroux, P.Eng, MASc, of Giroux Consulting Ltd., was based on a 3D geological model integrating 4,448 meters of diamond drilling of 43 drill holes, 2,290 assays, with 104 down-hole surveys collected between June and December 2006. The resource was reported utilizing gold cut-off grades ranging from 0.10 g/t to 3.00 g/t gold, as more particularly set out in the report. A complete copy of the report A gold cut-off grade of 0.50 g/t gold was selected as representing one possible mining scenario. For the purposes of the calculations, lognormal cumulative frequency plots were used to assess grade distribution to see if capping of high values was required and if so at what levels. For all elements, capping levels were established based on the individual grade distributions as follows: Gold - 18 gold assays were capped at 32.0 g/t gold, Silver - 9 silver assays were capped at 165 g/t silver, Copper - 7 assays were capped at 11.7% copper, Cobalt - 5 assays were capped at 0.48% cobalt, Iron - all iron assays were capped at 50% iron (the analytical detection limit).

3. BC Minfile Production Detail Report, BC Geological Survey. Minfile Number 092L 044

4. Benson Lake Mine historical reserves recorded by Cominco Resources (1972) report a non NI 43-101 resource of 454,000 tonnes grading 0.59 g/t Au and 1.3% Cu and Inferred resource of 2.7 million tonnes of 1.7% Cu with no Au grade calculated.

5. British Columbia Assessment Report 30,002, Grande Portage Resources Ltd, April 2008

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in this press release, including any information regarding the proposed Transaction, private placement, board, and management changes, as to our strategy, projects, plans or future financial or operating performance, constitutes "forward-looking statements." All statements, other than statements of historical fact, are to be considered forward-looking statements. Forward-looking statements are necessarily based on a number of estimates and assumptions that, while considered reasonable by Coast Copper, are inherently subject to significant business, economic, geological, and competitive uncertainties, and contingencies. Although Coast Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements. Such factors include but are not limited to fluctuations in market prices, exploration and exploitation successes, continued availability of capital and financing, changes in national and local government legislation, taxation, controls, regulations, expropriation, or nationalization of property and general political, economic, market or business conditions. Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance and, therefore, readers are advised to rely on their own evaluation of such uncertainties. All of the forward-looking statements made in this press release, or incorporated by reference, are qualified by these cautionary statements. We do not assume any obligation to update any forward-looking statements.